Tax evasion is a serious crime that can lead to significant financial penalties, interest on unpaid taxes, and even criminal charges. As tax laws continue to evolve, it is important to understand the latest updates, especially if you live or do business in Arizona.

The state has recently introduced changes to its tax laws that increase penalties for tax evasion, enhance enforcement efforts, and make it easier for authorities to track down those attempting to avoid taxes.

This guide will help you understand Arizona’s new tax evasion laws, explain the potential legal consequences of non-compliance, and provide practical tips to help you avoid tax evasion penalties.

What Are Arizona’s New Tax Evasion Laws?

Arizona has recently updated its tax evasion laws to combat a rise in fraudulent tax reporting and to improve tax compliance across the state. The new laws target a variety of illegal tax-related activities, including underreporting income, hiding assets, and falsifying deductions.

The goal is to increase transparency and ensure that both individuals and businesses are paying their fair share of taxes.

Some of the key updates to Arizona’s tax evasion laws include:

- Increased Penalties: Arizona has raised the penalties for tax evasion offenses, making it more costly to fail to comply with tax obligations. The penalties include higher fines, interest charges, and the potential for criminal prosecution.

- Stronger Enforcement: The Arizona Department of Revenue (ADOR) has strengthened its auditing and investigative powers, making it easier for state officials to track down tax evaders. With enhanced data analysis tools and more rigorous audits, the state is better equipped to detect tax evasion and identify those attempting to avoid paying taxes.

- Voluntary Disclosure Program: Arizona continues to offer a voluntary disclosure program for taxpayers who have made mistakes or unintentionally evaded taxes. By coming forward and disclosing unpaid taxes, taxpayers can potentially reduce the penalties they face.

- Expansion of Sales Tax Enforcement: Sales tax evasion has become a focus for Arizona’s updated tax laws. Businesses, especially those operating online, may face greater scrutiny regarding their sales tax collection and remittance practices. The state is also targeting businesses that misclassify workers to avoid paying payroll taxes.

Key Updates in Arizona’s Tax Evasion Laws

- Increased Financial Penalties: Under Arizona’s updated tax evasion laws, penalties for tax fraud have been significantly increased. Individuals convicted of tax evasion may face fines up to $10,000, while businesses could incur fines of $100,000 or more. In addition to fines, any unpaid taxes will accrue interest, further increasing the amount owed. The state has made it clear that tax evasion is a serious offense, and the consequences reflect this stance.

- Criminal Prosecution: Severe cases of tax evasion can result in criminal charges. Individuals and businesses found guilty of committing tax fraud could face felony charges, with the possibility of prison time. Depending on the severity of the offense, those convicted of tax evasion could face a prison sentence of up to 5 years.

- Tougher Audits and Investigations: Arizona is using advanced technology and data analysis tools to detect discrepancies in tax filings. With the expansion of online transactions, particularly for e-commerce businesses, Arizona is focusing on ensuring that all sales taxes are properly collected and remitted. Businesses with cross-state operations or those failing to report out-of-state income may face audits and penalties.

- New Reporting and Filing Requirements: Arizona’s Department of Revenue has introduced new requirements to make tax filings clearer and more transparent. This includes a more detailed breakdown of income and deductions for businesses, as well as enhanced reporting for contractors and freelancers.

How to Stay Compliant and Avoid Tax Evasion Penalties in Arizona

- Accurate and Transparent Reporting: One of the best ways to avoid tax evasion penalties is to ensure that your tax filings are accurate and complete. For businesses, this means carefully documenting all sales and expenses. For individuals, it means reporting all sources of income, including freelance or gig work, investment income, and side businesses. Double-check all deductions and credits to ensure they are valid.

- Timely Tax Filing: Always file your tax returns by the due date. If you miss the deadline, you may incur late fees and interest. In some cases, failure to file may raise red flags and increase the likelihood of an audit. If you are unable to file on time, request an extension from the Arizona Department of Revenue.

- Seek Professional Help: If you are unsure about your tax filings or the implications of the new laws, it is highly recommended that you seek assistance from a tax professional or accountant. They can help you understand the changes in Arizona’s tax laws, ensure that your filings are correct, and avoid any potential errors that could lead to penalties.

- Use Arizona’s Voluntary Disclosure Program: If you realize that you have made a mistake or failed to report income in the past, Arizona’s voluntary disclosure program offers a way to resolve your tax issues with reduced penalties. By proactively disclosing your errors before an investigation begins, you can potentially avoid the full extent of the penalties.

- Keep Detailed Records: Maintaining accurate and thorough financial records is crucial for avoiding tax evasion. Ensure that you keep all receipts, invoices, and financial statements related to your business or personal income. This will not only help you when filing taxes but will also be invaluable if you are audited.

- Cooperate During Audits: If you are selected for an audit, it is important to cooperate fully with the Arizona Department of Revenue. Provide all requested documents and information in a timely manner. If discrepancies are found, work to resolve them quickly, as cooperation during an audit can often lead to reduced penalties.

Legal Consequences for Tax Evasion in Arizona

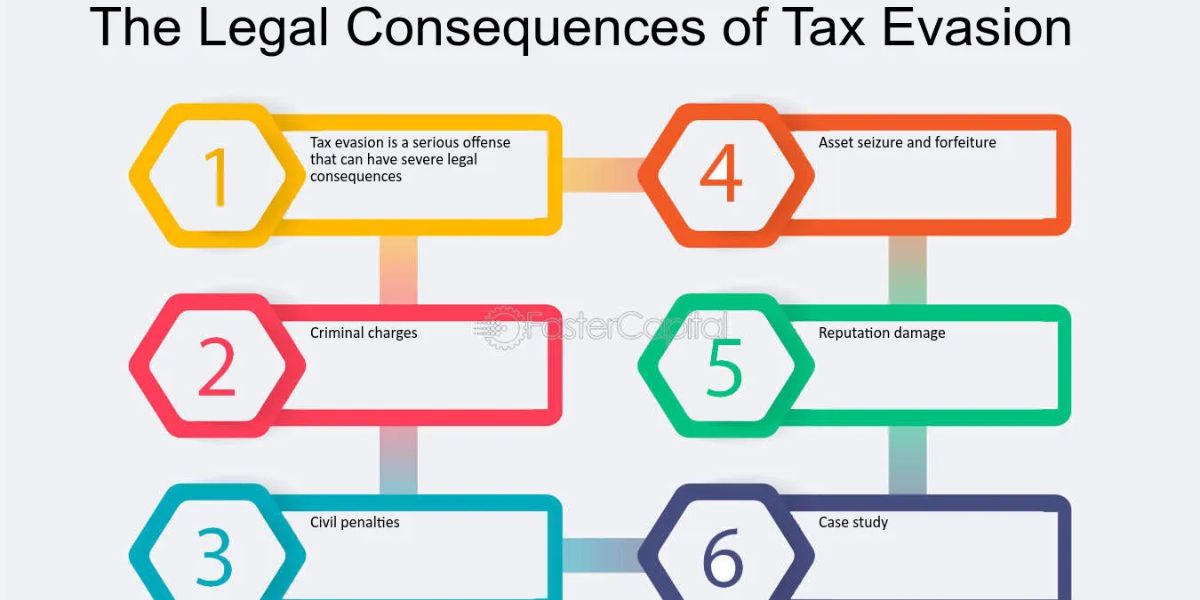

Tax evasion is a serious crime in Arizona, and failure to comply with tax laws can result in severe legal consequences:

- Fines: Individuals can face fines up to $10,000, while businesses may face fines up to $100,000, depending on the severity of the offense.

- Interest on Unpaid Taxes: Unpaid taxes will accrue interest, making the amount owed grow over time.

- Criminal Charges: In cases of severe tax evasion, individuals can be charged with a felony, which could result in up to 5 years in prison.

- Civil Penalties: In addition to criminal penalties, tax evaders may face civil penalties, which could involve additional fines or the requirement to pay back taxes with interest.

Arizona’s updated tax evasion laws emphasize the importance of accurate reporting, timely filing, and full compliance with state tax regulations. By understanding the changes to these laws and following best practices for tax compliance, you can avoid the serious consequences of tax evasion.

Whether you’re an individual taxpayer or a business owner, taking the necessary steps to stay compliant will help you avoid penalties, fines, and potential criminal charges. If you are unsure about your tax obligations or need assistance, don’t hesitate to consult a tax professional who can guide you through the process and ensure you stay on the right side of the law.

by

by